Note: It is recommended to go for early adoption to prepare for the GST invoicenow requirement so as to ensure a seamless transition to Xero.

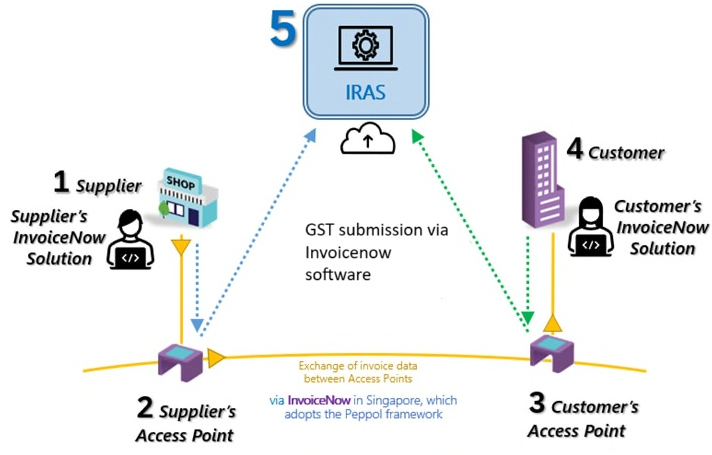

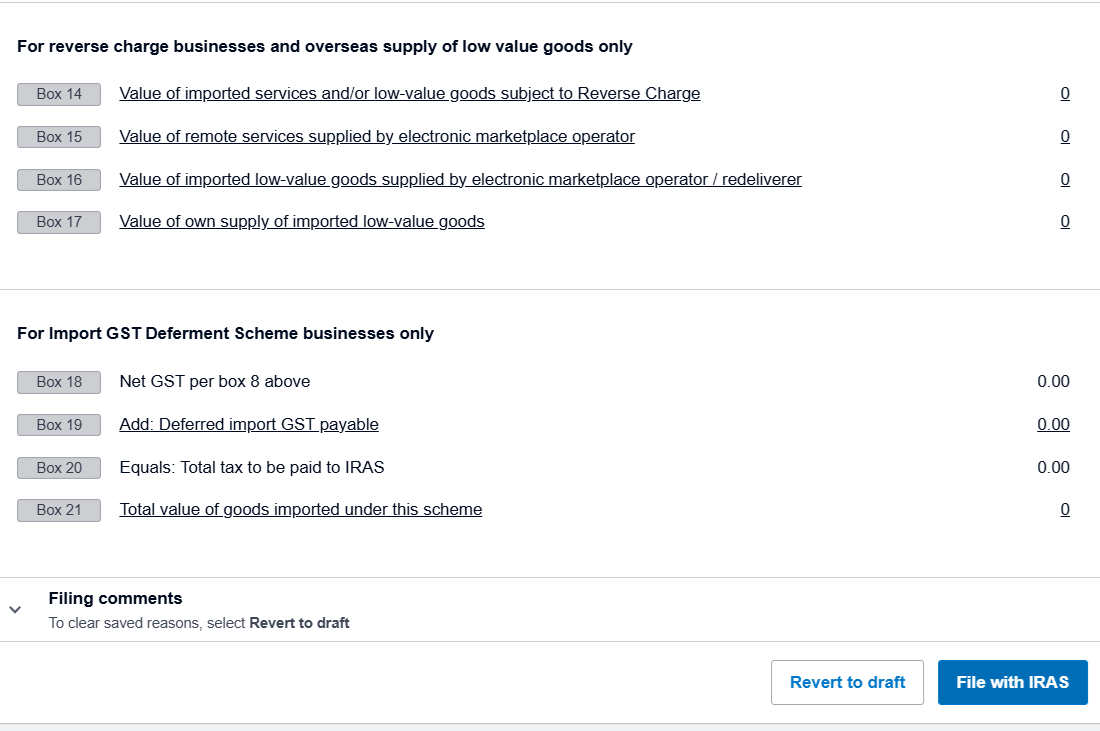

There are 2 parts of E-invoicing, the first part is Invoicenow for GST registered companies requirement wherby gst registered businesses have to use invoicenow solutions(Xero) , to do GST filing with IRAS by data transmission. Invoicenow for GST registered companies was introduced by IRAS.

The second part is InvoiceNow for invoicing requirement refers to the nationwide e-invoicing network, invoiceNow operates on Peppol framework, which directly transmits e-invoices in a standard digital format across different finance/ accounting software. Invoicenow for invoicing was introduced by the Infocomm Media Development Authority.

The above 2 parts will be explained in greater detail below.

Invoicenow for GST registered companies requirement

To support the nationwide InvoiceNow initiative, as part of the ongoing transformation efforts by the Inland Revenue Authority of Singapore (IRAS) to digitalise with the wider ecosystem and integrate tax into taxpayers’ accounting and payroll systems, GST-registered entities will have to use InvoiceNow solutions etc Xero Accounting software to send data to IRAS by GST filing by the software to optimise tax administration.

Phased adoption of GST InvoiceNow Requirement

To allow businesses sufficient time to prepare, the GST InvoiceNow Requirement will be implemented progressively from last quarter of 2025.

Invoice Now function for invoicing requirement

InvoiceNow is a government program and initiative for businesses to exchanges invoices with each other and using this mode of invoicing it reduces paper and in turn optimizes efficiency.

Xero Accounting Software is ready for E invoicing using InvoiceNow, both buyers and sellers have to use their respective accounting software to register their entity under the peppol network and will be allocated a peppol ID. Peppol ID serves as an identification point whereby both parties)buyer and seller) can send and receive e-invoices so long the corresponding party is registered under the e invoicing network.

How Xero Accounting Software sends and receives E invoices?

- The Vendor sends the E invoice to the Customer using customer company name and Peppol ID

- The Invoice is transmitted via the secure Peppol E invoicing Network via their accounting system

- Recipient receives the e-invoice via the Peppol E invoicing Network into their accounting system

Below are the benefits of using InvoiceNow via Xero accounting software

- Improve cash flow of the business as your customers will receive their invoices faster, enabling them to pay you faster, thus improving the cash flow of the business.

- Reducing administration time as invoices sent to your customers by Xero E invoicing will appear in their accounting software directly as compared to sending the invoice by PDF whereby your customer will have to open the PDF file and enter the invoice into their accounting software

- Greater accuracy in invoicing as the recipient of the invoice does not need to manually record the invoice into their accounting system, thus eliminating human error.

Kindly fill up your details on the contact us page on the right if you have any queries on Peppol E invoicing using Xero Accounting Software.